Screen 1 - Insurance Refile Time -- This specifies the number of days that allows

Medicare/Medicaid/Insurance claims to be refiled (only via forms-not electronic), and is

the number of days past due. In other words if the field contains 30, then after the claim

is 30 days past due, refiles will be enabled, and when refiled claims are selected from

the PRINT/FORMS/REFILES menu chain, then claims that qualify

will be printed (refiled).

Screen 1 - ALS/BLS Billing Method -- As defined by Medicare,

beginning January 1, 1995, New HCPCS codes will be optional until April 1, 1995, and

mandatory thereafter. There are 4 billing methods , and this may vary from carrier to

carrier. Consult with your carrier as to which method(s) are in use in your state. These

methods and HCPCS codes are elaborated in the section accessed via the menu selection MAINT/System Files/Supplies.

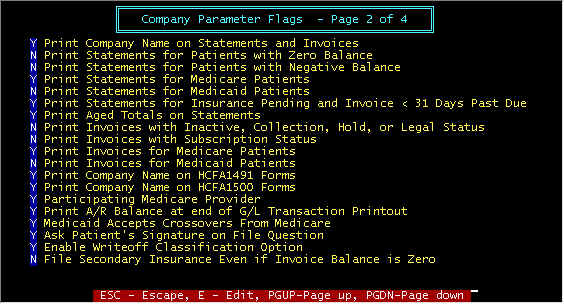

Screen 2 - Print Company Name on Statements and

Invoices -- N(o) if you are using pre-printed forms with your company name and

address.

Screen 2 - Print Statements for Patients with Zero Balance -- Print

statements for paid up accounts.

Screen 2 - Print Statements for Patients with Negative Balance -- There

is a patient report that list overpaid accounts. From this a check can be sent to the

patient, Medicare, Medicaid, Insurance Company that overpaid rather than send a statement.

Periodically, go to the PRINT/Patient List/Patients With

Negative Balance Invoices, and from this printed list reimburse the overpaid party, and

post a negative payment in the amount of the reimbursement so that the invoice will show

zero balance.

Screen 2 - Print Statements for Medicare/Medicaid Patients -- Per

preference of the EMS provider. It is recommended to print these for Medicare, but not

Medicaid so that when payment (in some cases Medicare copay) becomes the patient

responsibility, then prior statements shall have been received stating some thing to this

effect "We have filed with Medicare and awaiting payment – currently due from

you $0.00). You may not want a global lockout on sending

either a Medicare or Medicaid patient a statement by setting N(o) here, but may want

instead to individually prevent specific invoices to be included in statements. This

can be done by setting the invoice status to H(old). Note

that a rejection by either Medicare or Medicaid considers

that the invoice is no longer these payors, but becomes private pay at which time your

selection here is overridden.

Screen 2 - Print Statements for Insurance Pending and Invoice < 31

Days Past Due -- Per preference of the EMS provider to print statements not overdue

and insurance payment pending.

Screen 2 - Print Aged Totals on Statements -- Either print one

total due line or four lines plus total due line; the four lines are the due amounts

listed by time overdue (0-30 days, 0-60 days, etc.).

Screen 2 - Print Invoices with Inactive, Collection, .......... Status

-- normally not done

Screen 2 - Print Invoices with Subscription Status -- Invoices are

simply a notification of service, not necessarily a request to pay. This will

enable/disable notification of services for subscribed patients.

Screen 2 - Print Invoices for Medicare/Medicaid Patients -- normally

not done for Medicaid, normally done for Medicare. An invoice is not a request for payment

(except for private pay), but simply details of services performed, and is the only time a

patient receives a line item by line item listing of all charges. As with statements

(above) you may want to globally lock out printing invoices to

these payors, but do it on an individual basis.

Screen 2 - Print Company Name on HCFA 1491/1500 Forms -- Some forms

may already have your name and address printed.

Screen 2 - Participating Medicare Provider -- First, a definition

of what a participating provider entails, and then the pro's and con's of being one (and

this may vary from state to state, as well as locality-to-locality). To become a

participating provider requires that in November/December, proper application is made so

that the application can become effective beginning January 1st. This is binding for 12

months, and if it is desired not to participate, the following Nov/Dec, the application

must be made to get out. After becoming a participating provider, you must accept

assignment on all claims. Additionally, Medicare will crossover secondary insurance claims

via Medigap; approved Medigap codes must be included in the insurance company records.

This means that Medicare will file with secondary insurance companies for you. In some

states, Medicare automatically files with Medicaid for you, whether you are a

participating provider or not, and this may vary from state to state. One advantage of

being a participating provider is that Medicare checks are mailed to you. One disadvantage

is that you must accept the "Medicare Allowed" amount which may be considerably

less than your charges, and the difference between what is charged and what Medicare

"Allows" must be written of as a Medicare Contractual Writeoff, and by law is

uncollectable by any means. Medicare will pay 80% of the allowed amount, and it is your

responsibly (and obligation) to collect the remaining 20% from secondary co-pay sources

(insurance, Medicaid Private Pay, etc.). In non-participating cases, you can collect the

full amount from the patient, whereupon you file for them, but the check is mailed to the

patient. Whether or not being a participating provider is advantageous is strictly on a

case-by-case basis, and best determined by each provider. If you are in a locality with

more than one provider, you may be at a competitive disadvantage if the other provider is

participating and you are not, since the financial obligation may be less for the patient

using the participating provider. There is a HCFA mandate in the works that all

providers MUST be participating.

Screen 2 - Print A/R Balance at end of G/L Transaction Period -- At

the end of each transaction period (usually daily), G/L transactions are printed for

journal entry into an independent G/L system. The computed balance can either be printed

or not by the Y/N entry into this field, The down side of printing this balance is the

compute time required, but in most cases is not objectionable.

Screen 2 - Medicaid Accepts Crossovers From Medicare -- If Medicaid

is secondary to Medicare, in some states Medicare will file automatically with Medicaid

for you. If selected, the secondary date filed field in the invoice file will be

automatically set to the date filed with Medicare: ACCEPTED: Alabama, Florida, Georgia,

Mississippi, North Carolina, Tennessee. NOT ACCEPTED: Kentucky. Note that this is subject

to change, and you should check with Medicaid.

Screen 2 - Ask Signature On File Question if Medicare Paycode -- If

N(o), the phrase "Signature On File" will be printed on HCFA1491 forms, and the

Medicare paycode window in the invoice screen will not have this message and field. If

Y(es), this question is displayed each time a Medicare paycode is selected in an invoice

paycode window: Sign. On File Y/N

Screen 2 - Enable Writeoff Classification Option -- If N(o), All

writeoffs will have the same classification. If Y(es), the operator can classify writeoffs

when posting payments and these classifications are printed in the TRANSACTION LOG and

OPERATIONS report. Additionally, if Enabled, then you will have an adjusted collection

efficiency (bottom half of OPERATIONS report that gives you credit for contractual

writeoffs. Recommend enabling with Y(es).

Screen 2 - File Secondary Insurance Even if Invoice Balance is Zero -- Preference

of the EMS provider whether or not to file secondary insurance after the invoice has been

paid. Normally not done.

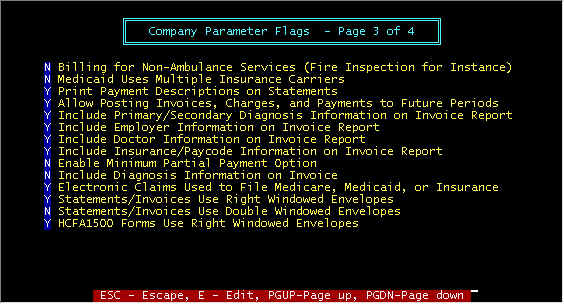

Screen 3 - Billing For Non-Ambulance Etc. -- A

separate company can be created to allow billing for Non-Ambulance services (fire

inspection, e.g.). Statement and Invoices will have no reference to patients.

Additionally, all services of this type must be on a separate company, not mixed with

normal EMS services.

Screen 3 - Medicaid Uses Multiple Insurance Carriers -- If this

flag is set to Y, the insurance company (carrier) code entry will be required when a

Medicaid paycode is entered (in the invoice), with subsequent data entries as though an

insurance company paycode had been entered. The insurance company name is printed at the

top of the HCFA1500 form. , with the only exception being when Medicaid is secondary to

Medicare. If MEDICAID IS SECONDARY TO MEDICARE, the insurance company code will not be

required, and this is the only exception. Only a few states are using multiple insurance

carriers for Medicaid claims; examples are Tennessee and Arizona.

Screen 3 - Print Payment Description on Statements -- When posting payments, a payment description can be entered, and if

this option is enabled here, this description will be printed on statements, and is

helpful for the patient to understand the statement. For example, the description next to

a Medicare payment may read "$100 deductible, $53.92 patient copay". With such a

message, the patient should understand why they owe $153.92. However, some patients do not

read, and thus use of a highlight pen is helpful to point out certain areas such as this

where you would like to attract their attention.

Screen 3 - Allow Posting Payments Invoices, Charges and Payments to

Future Periods -- If the month has not been closed and you are in the next month,

enabling here will allow entering/posting in a month that is future to the current period

(month). This will create accounting discrepancies (amounts) on statistical reports by

month, and is not recommended.

Screen 3 - Include ....................On

Invoice Report -- In the main invoice screen, the R-Report

option will print all information about the highlighted invoice so that this report can be

turned over to a collection agency, legal authorities, etc. Certain options here will

determine what data to exclude/include from this report.

Screen 3 - Enable Minimum Partial Payment Option -- For private pay

where a monthly payments have been established, a payment

lower than minimum will not be considered as adequate so as to eliminate past due

statements (see PAYCODE7 records per section Fi.9 (menu tree FILES/9-Paycode 7 Private

Pay).

Screen 3 - Include Diagnosis Information on Invoice – Normally

not done

Screen 3 - Electronic Claims Used to File Medicare, Medicaid or

Insurance – Y if either of these are electronic

Screen 3 - Statements/Invoices Use Right Windowed Envelopes – Y

= right window, N = left window

Screen 3 - Statements/Invoices Use Double Windowed Envelopes – Prints

both Mail-to and return addresses in windows

Screen 3 - HCFA1500 Forms Use Right Windowed Envelopes – The

mailing address will print on the left or right side (in the envelope window position)

depending upon your choice here. Y = right window, N = left window. Some vendors supply

laser forms with a bar code in the left window, and thus right windows are required.

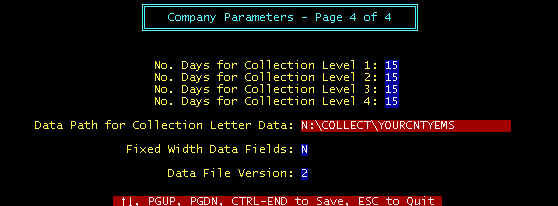

Screen 4 - No. Days for Collection Level 1 -- Extraction

of collection letters has programmable features. The number of

days is the elapsed time since the last letter was extracted before the next letter is

eligible for extraction. For example, 15 days (minimum) must lapse from the time

collection letter 1 is extracted before collection letter 2 is eligible for extraction;

then 20 days until collection letter 3, etc. The data path is simply the disk directory

where the collection data is stored. Select N(o) for word processor mail merging and

(Y)es) for EQUIFAX -- No=take out space-filled characters that could result in unwanted

spaces, between first name and last name, e.g.

Screen 4 - Data Path for Collection Letter -- Each time collection letters are extracted, the files LETTER1.DAT,

LETTER2.DAT, etc. are written to disk drive C, subdirectory COLLECT, with a series of

records, one for each patient, and each record has the data format as shown below. Note

that the drive and subdirectory can be specified, and the ones shown here are for example

only. If collection letter 1 is being extracted, the system erases the file

C:\COLLECT\LETTER1.DAT, and then rewrites a new C:\COLLECT\LETTER1.DAT (if any are

extracted), otherwise there will be no existing LETTER1.DAT. This ensures that specific

collections letters (letter 1, 2, etc.) are only sent one time.

Screen 4 - Fixed Width Data Fields – Yes for EQUIFAX, No for all other.

Screen 4 - Data File Version – As data the extracted data files are changed, added to, etc. as time goes on,

new data versions are generated so that users of data 1, 2, etc. who do not choose to

change to newer versions so as not to disrupt your current usage (word processors,

collection agencies, etc.) will not need to be changed.

Extraction Data Format for Collection Letters -- The different data

versions are discussed in more detail under the menu COLLECT.

Shown below is data version 2, for example:

"M1

-10002","MURPHYJS","10/22/92","John","S","Murphy","John","S","Murphy","Rt.

2, Box 231M","Green

Mountain","CA","62813-9523","(555)","555-1212","256-09-3044","193.00","0.00","193.00",

"Y"

Note that the computer converted from all CAPITAL (Upper Case) to Upper

and lower case-this is because collection letters do not look good in all CAPS. You may

recognize the data as: Invoice Number, Patient Code, Service date, Patient Name,

Responsible Party, Address, Phone, Social Security Number, Charges, Payments, Balance due.

Note that the N(o) option was chosen for the example. See Section D-Collect for more

details